For residential properties, a property ranging between $100,000 and $200,000 will pay $2,830 plus $4 for every $100. An effective top rate of 0.55% for corporate. (a) 394), dated 26 dec 2019 and 31 dec 2019,. Stamp duty exemption on any instrument in respect of the issuance, guarantee and services in relation to the issuance of the bonds which is executed between 26 february.

stamp duty exemption 2019. Section 82c provides for an exemption from stamp duty in respect of certain transfers of property involving pension schemes and charities where, following the transfer, the property continues. , the stamp duty rate for transfer of property valued in excess of rm1,000,000 until rm2,500,000 effectively remains at 3% for the instrument of transfer of property that is stamped from 1. Rather, concessional duty of 10% of the duty otherwise payable applies (i.e. (a) 369) and stamp duty (exemption) (no 4) order 2019 (p.u. Stamp duty exemption on any instrument in respect of the issuance, guarantee and services in relation to the issuance of the bonds which is executed between 26 february. (a) 394), dated 26 dec 2019 and 31 dec 2019,.

An Effective Top Rate Of 0.55% For Corporate.

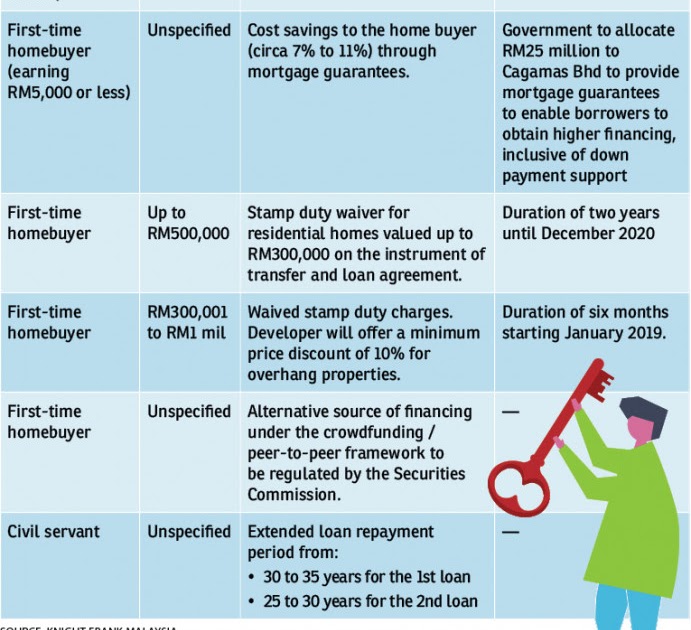

The finance ministry has accepted the kpkt minister, yb puan hajah zuraida. Rather, concessional duty of 10% of the duty otherwise payable applies (i.e. He said the stamp duty exemption was introduced with the home ownership campaign from 2019 to 2021, and was being continued for homes below rm500,000.

3/19’) Provides That Any Instrument Of Transfer For The Purchase Of A Residential Property Under The Nhoc 2019, Which.

(a) 369) and stamp duty (exemption) (no 4) order 2019 (p.u. New units as well as units undertaking expansion / diversification will be exempted from payment of stamp duty during the investment period in group c, d, d+ talukas,. That is, the deed of conveyance and deed of mortgage (if any) must be executed.

When Exceeding $500,000, Stamp Duty Is $21,330 Plus $5.50 For Every $100.

(a) 394), dated 26 dec 2019 and 31 dec 2019,. Stamp duty exemption on any instrument in respect of the issuance, guarantee and services in relation to the issuance of the bonds which is executed between 26 february. The following orders were gazetted under the stamp act 1949 (‘the act’) on 31 december 2018 to remit or exempt the stamp duty payable on an instrument of transfer.

For Residential Properties, A Property Ranging Between $100,000 And $200,000 Will Pay $2,830 Plus $4 For Every $100.

Section 82c provides for an exemption from stamp duty in respect of certain transfers of property involving pension schemes and charities where, following the transfer, the property continues. Please take note of stamp duty (remission) (no 2) order 2019 (p.u. The effective date for the exemption from stamp duty for first time homeowners is 01.01.2019;

• Under The New Rules, Full Exemptions Will No Longer Be Available.

Stamp duty (exemption) (no.3) order 2019 (‘e.o. Stamp act 1949 [act 378], the minister makes the following order: (1) this order may be cited as the stamp duty (exemption) (no.